In the dynamic world of digital marketing, where strategic decisions are paramount, understanding your finances is the foundation of sustainable growth. Businesses often find themselves at a crossroads, juggling expenses and revenue, wondering how to navigate the complex terrain of costs. But simply breaking even isn’t good enough. When you’re starting a business, launching a new product or service, or changing up your business model, making a profit is always the goal.

This is where break-even analysis comes to the party, drinks in hand, ready to shake things up. Knowing your break-even point is essential in determining the viability of your business. It will form the structure of your pricing model and ultimately will take the wheel, steering you into the fast lane towards growth and that all-important goal: Profit.

So, What is a Break-even Analysis?

At its core, a break-even analysis is a financial evaluation that tells you the exact point at which your total revenue matches your total costs, resulting in neither profit nor loss. The sweet spot that is “break-even”. With a simple formula, you can determine how much product you need to sell, or income you need to generate, to cover all of your business costs and start making a profit.

Why is Break-Even Analysis so Important?

For businesses, irrespective of their industry, a break-even analysis is the guiding light. It illuminates the path towards profitability and sustainability, so you know which route you need to take to reach your destination (Profit-Land). Here’s why every business, from eCommerce startups to service-oriented businesses, needs to embrace break-even analysis:

- It helps you make informed decisions. A break-even analysis informs crucial decisions in your business, from pricing strategies to resource allocation. When you know what your individual unit costs are, and how many of those units you need to sell in order to cover your operating costs, you can make informed decisions about your pricing strategy and identify where changes need to be made. You can then set sales targets and strategic marketing budgets to guide your drive towards profitability.

- It helps to manage risks: Operating without a clear understanding of your break-even point is akin to sailing without a compass. Break-even analysis guides businesses away from financial storms and helps them navigate market uncertainties. You’ll have the confidence to determine if a new sales avenue, product or venture is going to be viable, and if increasing your marketing activities will yield a stronger result.

- It arms you for growth: Geared up with the insights from break-even analysis, businesses can effectively strategize for growth. It provides a roadmap for scaling operations, optimising marketing efforts, and expanding product lines, all while maintaining a healthy bottom line.

How Do I Perform a Break-Even Analysis?

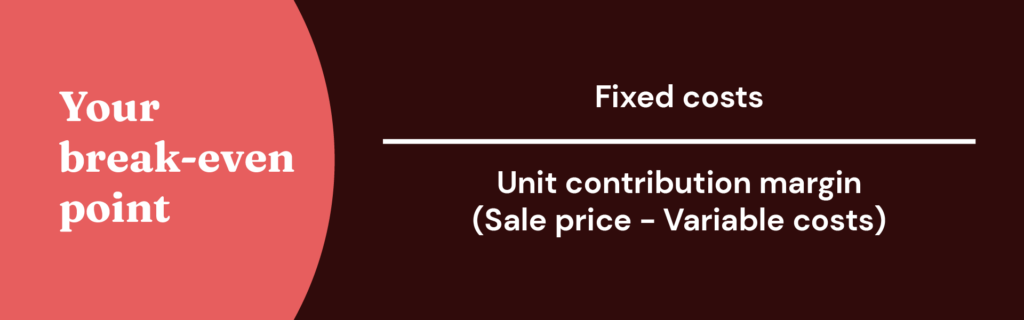

Performing a break-even analysis involves dissecting your costs into fixed and variable categories, and understanding your pricing structure. It’s a universal practice, applicable to businesses in all sectors. It uses a super simple and super powerful formula:

Your break-even point: fixed costs/unit contribution margin (sale price – variable costs)

You’ll see that to determine your break-even point, you also need to know what your business’s fixed and variable costs are.

What is a Fixed Cost?

Fixed costs are the backbone of your business, encompassing expenses that remain constant irrespective of your production or sales volume. Fixed costs are things like rent or mortgage repayments, agency retainer fees, insurance, and software subscriptions. In simple terms, the expenses for the running of your business rather than the costs of producing your product.

What is a Variable Cost?

Variable costs fluctuate in direct proportion to your production or sales volume. These costs include things like raw materials, packaging, shipping, and digital marketing spends. The amount you spend to produce and sell whatever it is you’re offering.

Variable costs are crucial indicators of your business’s flexibility and scalability. Managing variable costs effectively ensures that expenses rise or fall proportionally with your sales, allowing your business to adapt to market demands efficiently.

How Do I Calculate My Break-Even Point, You Ask?

Calculating the break-even point can be approached in two ways; using units (quantities of products or services sold) or sales dollars (revenue generated from sales). Both methods offer valuable insights into your business’s financial stability.

Break-Even Point in Units

Understanding your break-even point in units provides clarity on the minimum number of products or services your business must sell to cover all operating costs. It’s particularly useful for businesses with multiple product lines or service offerings.

Break-even Point in Sales Dollars

Calculating the break-even point in sales dollars offers a broader perspective, giving you the total revenue required to cover all costs. This method is valuable for businesses with varying price points or those offering custom products or services. The formula is similar but includes the product’s contribution margin in the calculation; that is the percentage of your product’s sales cost that is left after all the product costs are paid for. Essentially, the percentage of the sales price that contributes to your profit.

How to Improve Your Unit Economics

Easy. Pump up your prices and on-sell complementary products, services or bundles.

It can’t be that simple, right?

Right.

Unfortunately, pricing is a sensitive subject for most customers and changes are usually ill-received and ill-fated. A safer approach is to look at your costs.

Lowering your Fixed Costs

There’s a power in knowing what your fixed operating costs are, and that is the knowledge to make an informed change. Now that you have an accurate picture of your fixed costs, you’ll be able to identify unnecessary expenses that can be removed, reduced or renegotiated.

Something like a software subscription you rarely use, or changing your electricity provider, can make a real difference to your bottom line. Or, you can look to review your agency agreements. How long has it been since you reviewed the scope? Are you paying for unnecessary activities?

Aperitif can help here. We’re a boutique agency that delivers true value for money. We don’t pass on the overheads of a flashy studio or inflated salaries like other agencies do. Instead, we make your budget work hard, and fast, so you can reduce your costs while holding onto the performance of your digital marketing efforts.

Lowering your Variable Costs

Reviewing the performance of your digital marketing is a straightforward method of reducing the variable costs in your budget.

Reducing your cost-per-acquisition could be as simple as driving down your average cost-per-click (CPC) by removing redundant and/or expensive, non-converting keywords. You could also look at improving your ads creatively with copy and visuals that generate a better conversation rate.

If this sounds a little scary, then it’s time you gave Aperitif a call. Forget the lingo and let our team take the driver’s seat so you can get a better result while reducing your variable costs, to hit that profitability target earlier.

Ready to master your business growth? We don’t just provide tools, we provide solutions.

Aperitif’s team of virtual CMOs will help make every marketing dollar stretch further, turning your business into a revenue-generating machine. Get in touch with us today for a free marketing strategy review.